Plaza-i Accounts Payable

Plaza-i Account Payable

Handles payable entry, payment, and A/P account management for all kinds of industry.

Overview

【Handles payable entry, payment, and A/P account management for all kinds of industry.】

Payment request data can be transferred from Plaza-i Purchase Management (PUR), General Purchase (GPM), and Expense Settlement (EPS), and the accounting department can manage payments for all the departments.

When the accounting department staff checks all the payment request forms which have been approved by each department, makes payable entries, and then approves, the system will process and complete accounting and payment processes.

It is highly recommended that you use this module together with Plaza-i Accounting (GLS).

Features

When you enter invoices that you received, and approve the data,

1) journals, which record 【debit】 expense (or purchase, etc.), suspense paid c-tax, / 【credit】 account payable,

will be created in the Accounting module automatically. When you confirm the payment by due date,

2) journals, which record 【debit】 account payable / 【credit】 cash, etc.

will be created in the Accounting module automatically.

・All you need to input in Payable Voucher and Direct Payment Voucher is only a payee and entry details

・Real-time vendor summary

・Payment method/due date change functions

・FB data creation, payment deduction, withholding tax management

・Due date payment, notes payment, advance payment, foreign currency payment

・Automatic generation of notes payable data

・Working with Plaza-i Forward Exchange Contract

Main menu + Screen image

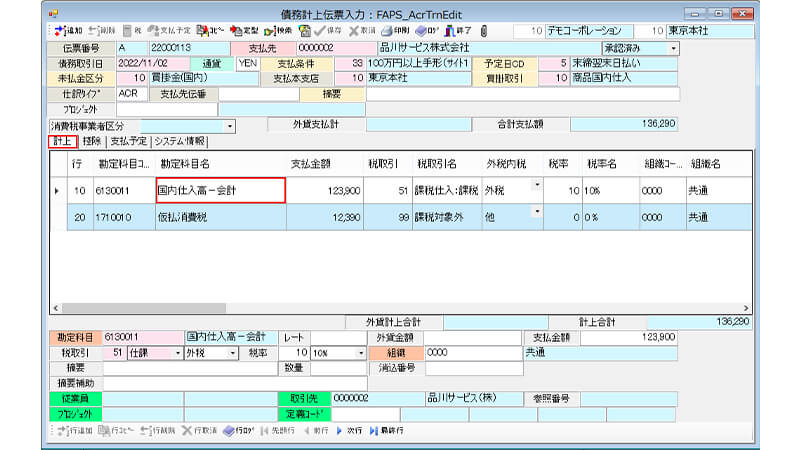

・Payable Voucher Entry (Batch Generation, External Data Acceptance, Direct Payment)

・Payable Approval

・Payable Balance Inquiry

・Payable Sub-Ledger

・Payment Method Change

・Remittance Notice, Accounts Payable Confirmation Letter

・Payment Approval, Payment Approval Reversal, Payment Execution

・FB Data Creation

・Payable Balance List

・Payable Detail Balance Report, Detail List of Payable Accounts

・Payment Record, Withholding Tax Payment Schedule

Detailed features

Real-Time Vendor Summary

・When you approve a payable entry voucher or direct payment voucher, Plaza-i will automatically aggregate amounts by payee and by due date (real-time vendor summary).

・Furthermore, according to the settings in Bank Charge Master registered per bank, bank charges will be automatically calculated, and also based on the settings of the “bank charges paid by us” status in Payee Master, payment amounts will be calculated.

・Automatic division of payment is available for such transactions as “half cash half notes” based on the amount after vendor summary, and due dates are automatically determined according to such conditions as“cash payment on due date”.

Payment Method Change/Due Date Change (Offset is supported)

・Once a payable entry is approved, the data such as amount and account code cannot be changed as in the same case with journal approval (implementing internal controls).

・You can, however, change the payment method and due date until payment approval is completed.

Working with Bank’s FB System

・Firm banking (FB) through the internet such as Web-Banking is supported.

・By using the FB data with “Zenginkyo (Japan Banker’s Association) format” created by Plaza-i Payable system, you can omit the process of making entries such as payee, transfer-to, and payment amount in the FB system.

・Overseas remittance is in part supported.

Advance Payment

・Payment can be processed in advance and then the payment amount will be offset with payable amount recorded later.

・Advance payment amount will be recorded when the payment execution is completed. And then when the payable is recorded for the same payee later, the advance payment amount will be offset with it.

Foreign Currency

・Payable entry and payment can be made in any currencies.

・When using Plaza-i Forward Exchange Contract (FEC), you can create direct payment data based on several forward exchange contract transactions that have been allocated. For the unallocated portion, payment process can be executed by specifying a payment bank account in the payment method change screen.

・Foreign currency denominated payable balance will be converted at the end of each month, and a journal will be automatically created to record the difference.